Spy 100 Day Moving Average

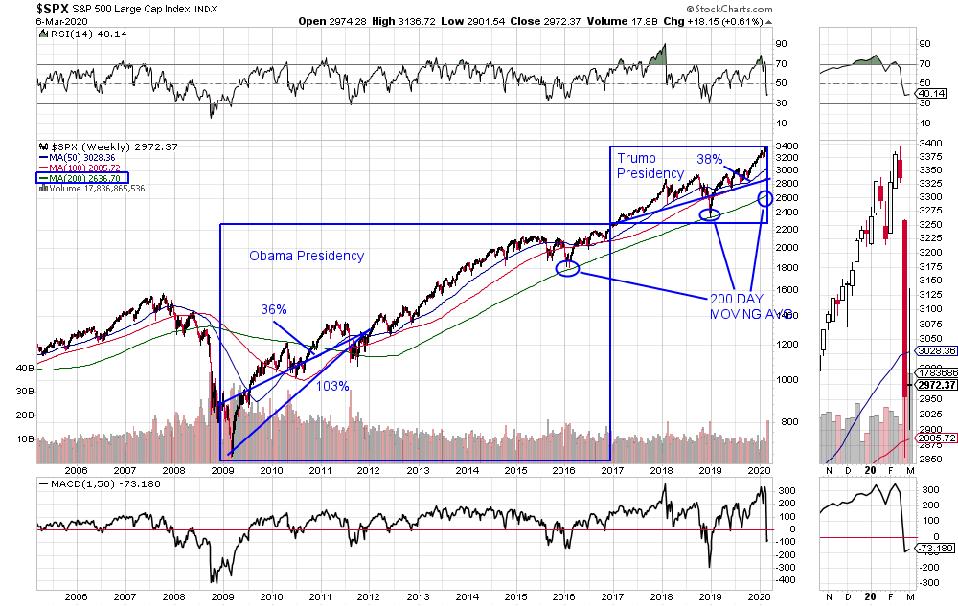

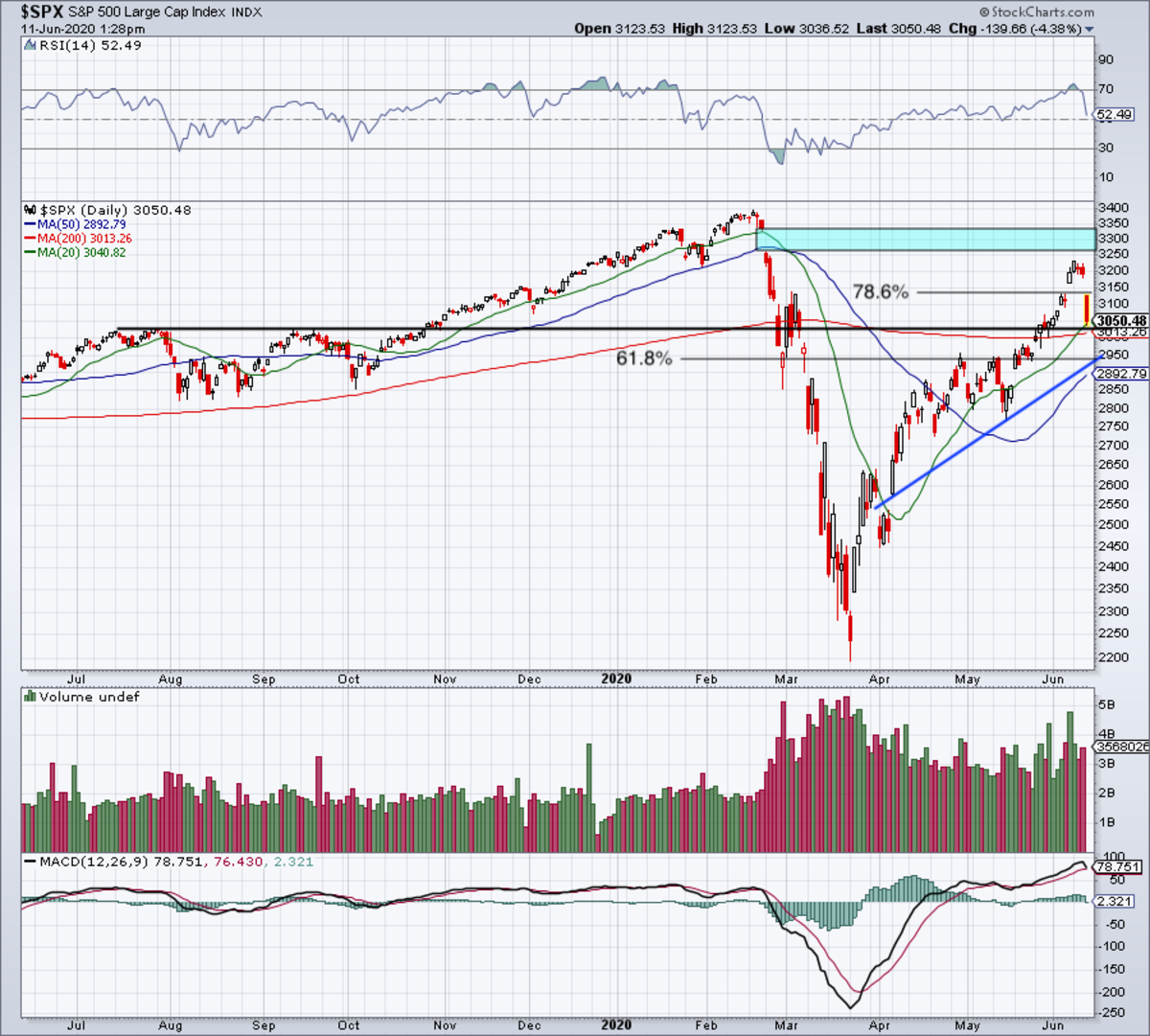

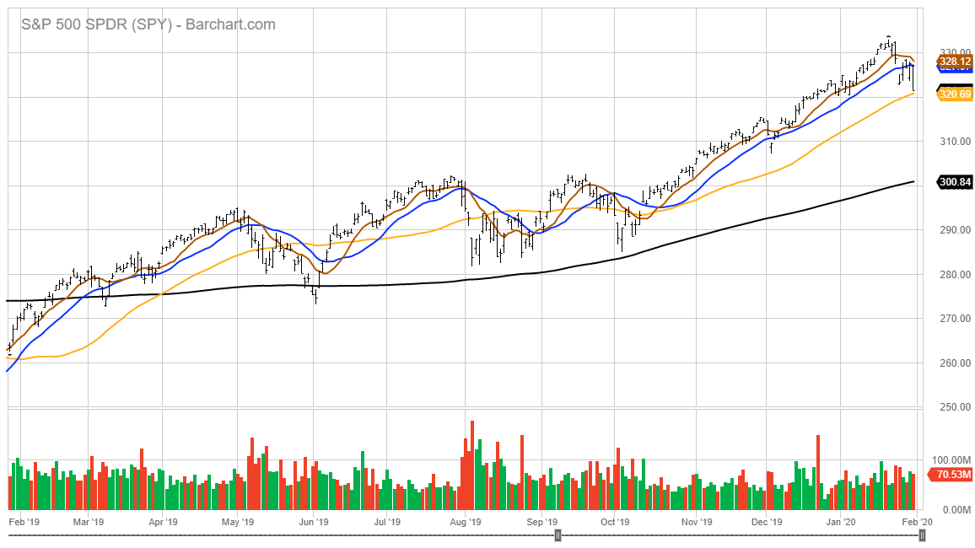

Looking at the chart above, SPY's low point in its 52 week range is $232.51 per share, with $286.58.

Spy 100 day moving average. We’ll discuss the SPDR Dow Jones Industrial Average ETF (DIA) and the SPDR S&P 500 ETF’s (SPY) moving averages. The 0 day moving average is a technical indicator used to analyze and identify long term trends. Over the past ten years, this system would have produced an average annual return of 5.73%.

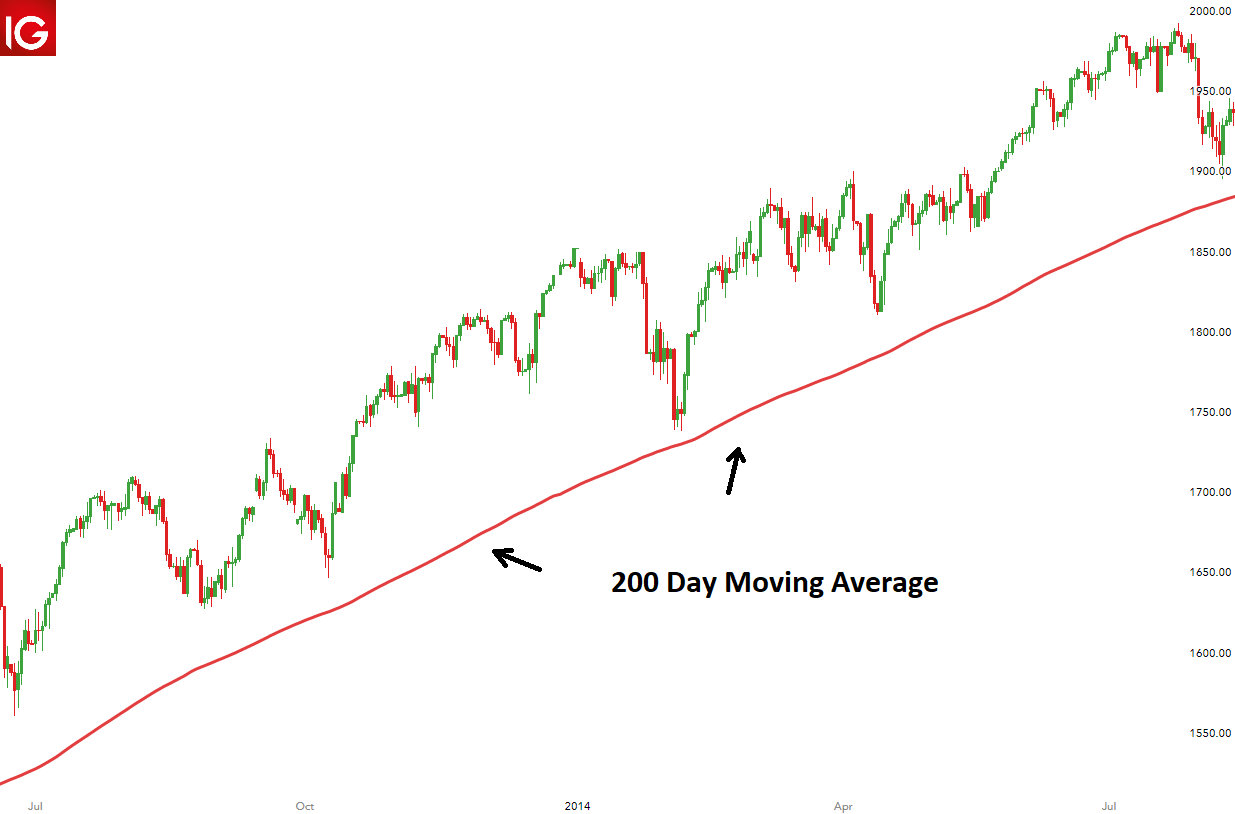

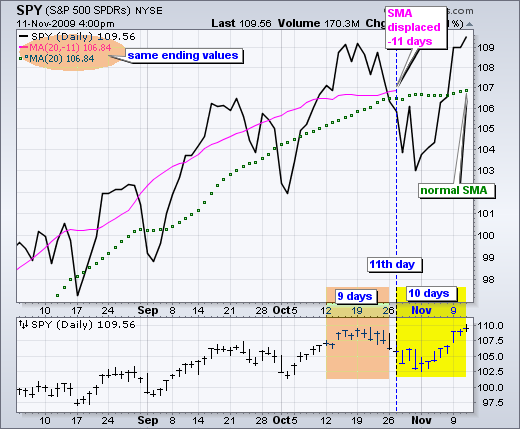

This is an important trading signal for institutional traders. Whether you are using the 50-day, 100-day or 0-day moving average, the method of calculation and how the moving average is interpreted are the same. 0-day Moving Average is widely used to analyze major market trends.

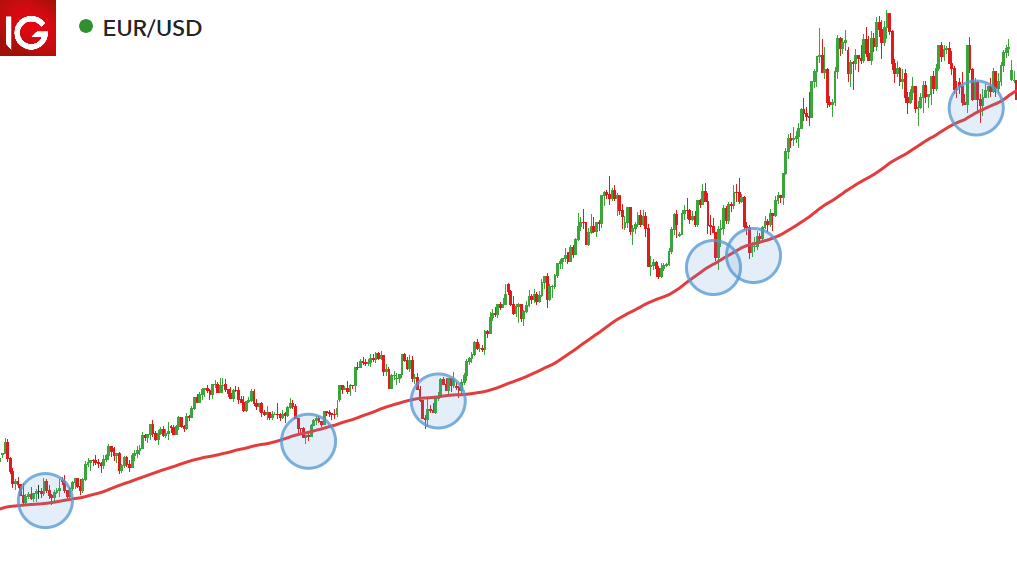

It only happened 2 times, ever.Will this be 3rd?. Submit Printout Of Plots And Last Days Of Data. In an uptrend, a 50-day, 100-day or 0-day moving average may act as a support level, as shown in the figure below.

A longer moving average (such as a 0-day EMA) can serve as a valuable smoothing device when you are trying to assess long-term trends. Well, the 50 is a multiple of the 100 and 0-day moving averages. At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life.

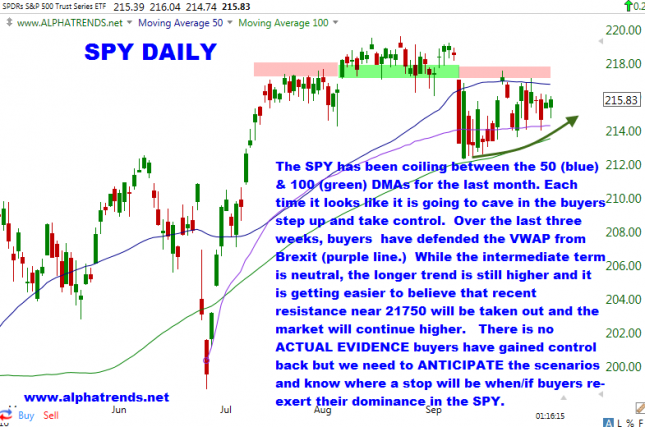

These traders will buy when price dips and tests the moving average or sell if price rises and touches the moving average. This list shows which stocks are most likely to have their 50 day SMA cross above or below their 0 day SMA in the next trading session. Let's rewind the clock back to the Brexit in June 16.

Here’s a look at the 15-minute chart of GBP/USD and pop on the 50 EMA. 5 Tips for Using a 0-Day Moving Average 1) Make sure the price action respects the 0-day moving average. This is because the average acts like a floor (support), so the price bounces up.

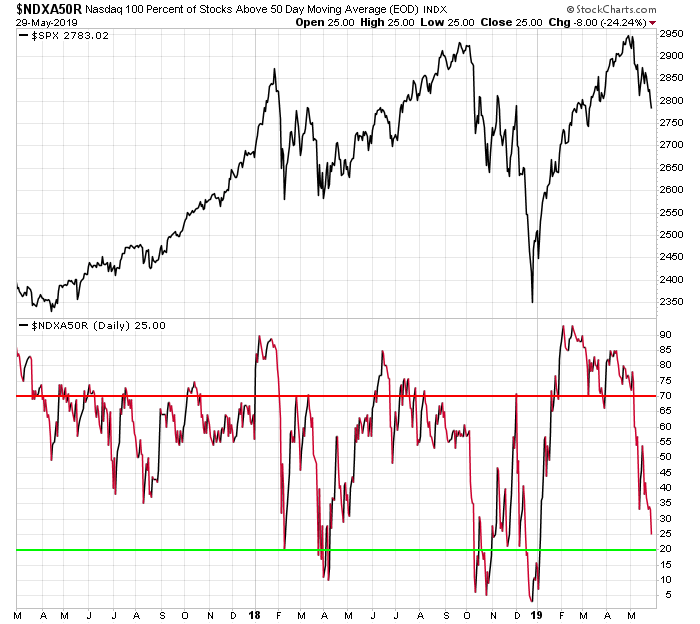

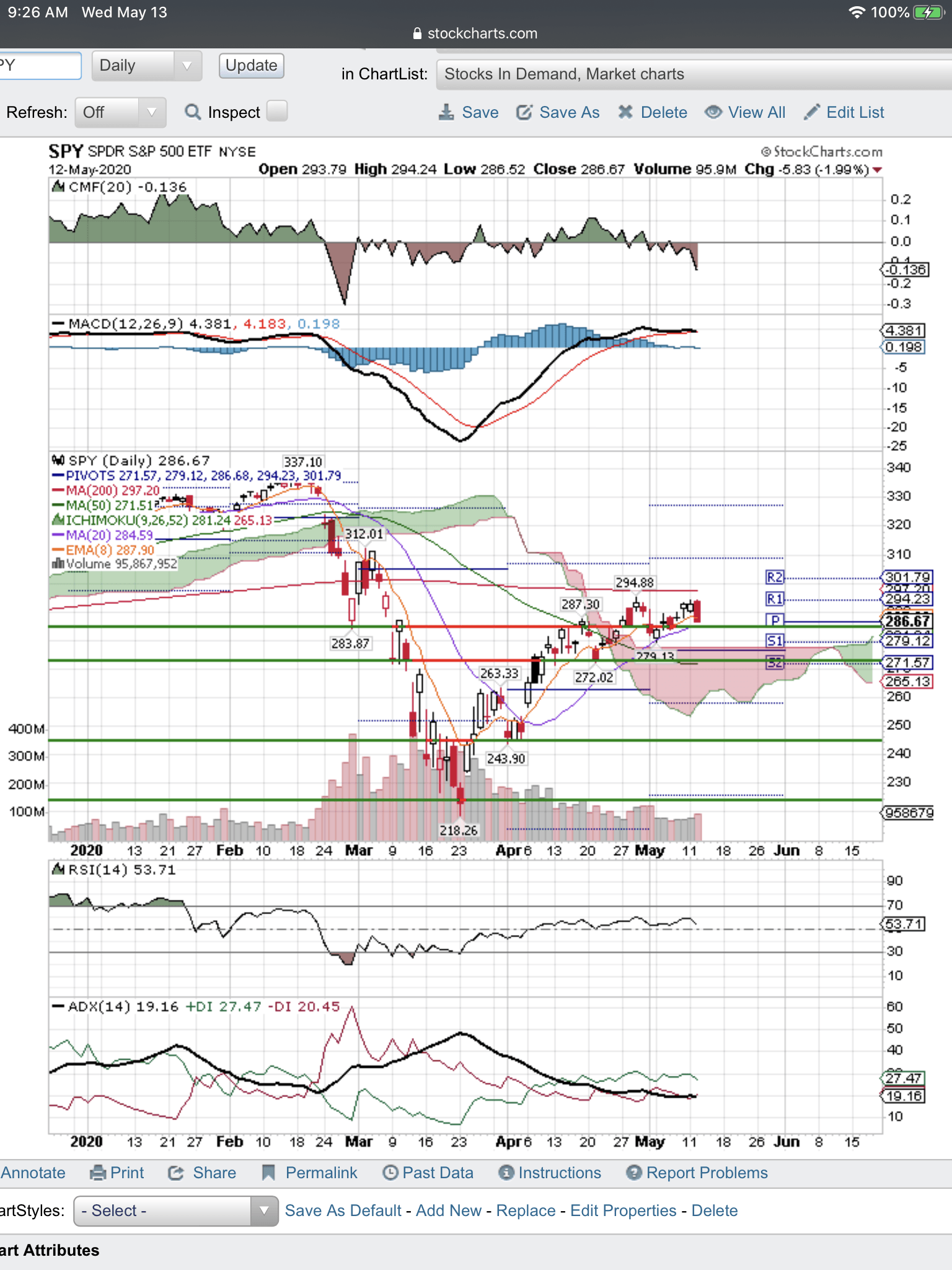

The 50-day moving average indicator is one of the most important and commonly used tools in stock trading. 2-day RSI of SPY < ;. 10 Unit SMA crosses above 100 unit SMA.

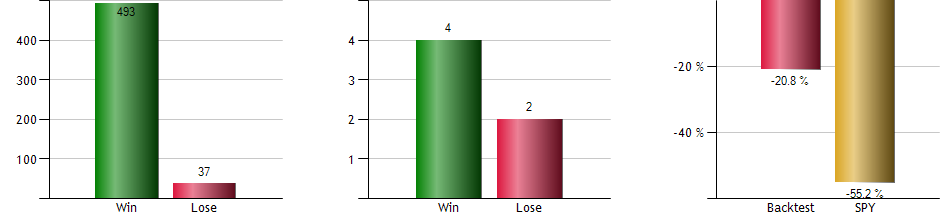

Today we will go through 6 tips for how to use a 50-day moving average. Other moving averages can be of varying length, such as 50-day, 100-day, etc. What software did you use to perform the historical backtests?.

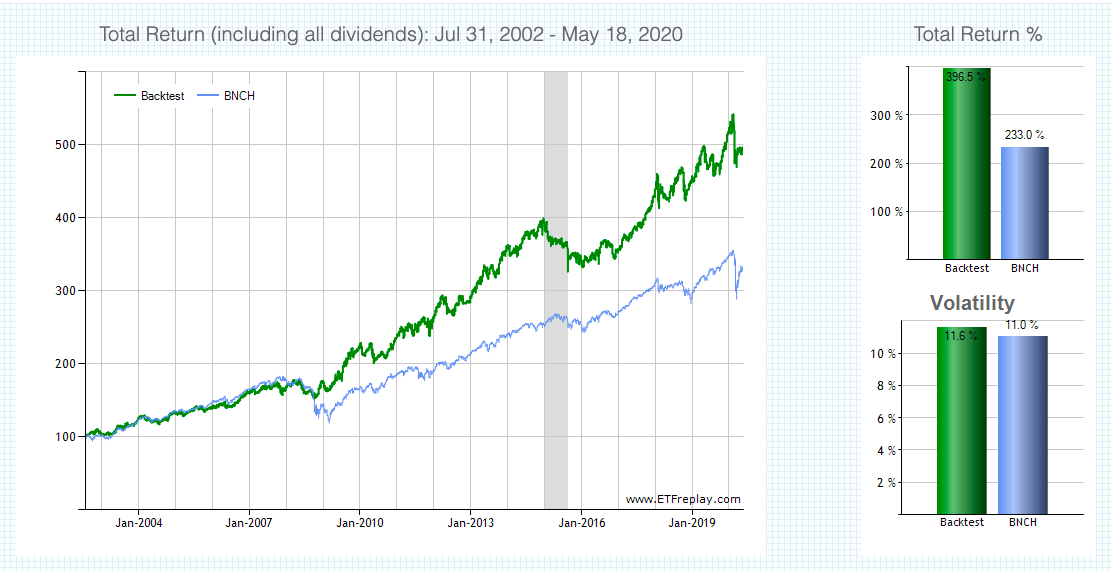

I rarely care much "why" the market moves. (i) go long the S&P 500 SPDR ETF (SPY) whenever the index closes above the 0-day moving average and (ii) go short whenever the index closes beneath. Forget the 0-day moving average.

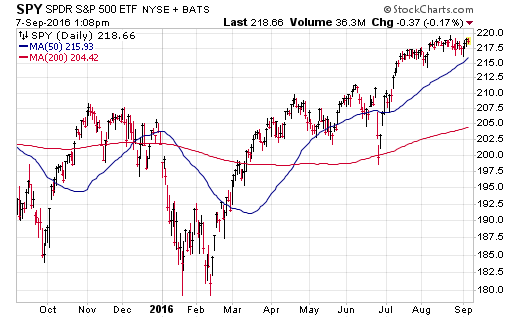

Add Data From Yahoo As Needed. If the price is below the 0 day moving average indicator, then look for selling opportunities. The chart below of the S&P Depository Receipts Exchange Traded Fund (SPY) shows the 50-day Simple Moving Average and the 0-day Simple Moving Average;.

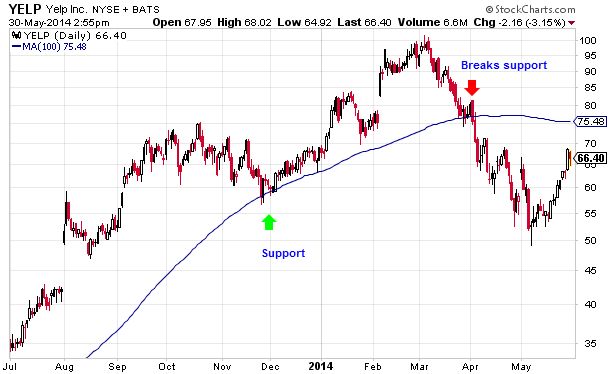

On the upside, let’s see if SPY can rally to its 100-day moving average. Let’s take a simple backtest of how buying SPY when the 2-period RSI was below on the daily chart. A moving average is green if the current price is above its moving average.

It is red if the current price is equal to or below the moving average. Notice how the second longest streak just ended towards the end of October. While the 50-day moving average may appear to offer support or resistance to price, it is an illusion.

0 point is very important because last spy was broke down as it went down to 0 point and came all the way down to 181. Those numbers are added up and divided by 100. Before you do anything with the 0-day moving average, you first need to see if the traders controlling the stock care.

Essentially, it is a line that represents the average closing price for the last 0 days and can. That is how moving averages are created. On the upside, though, see if the stock can reclaim its 100-day moving average.

If it falls this far it would be a drop of 22% from its all-time high. We chose monthly since daily data does not go back that far for many of the asset classes. The chart below is a weekly chart for the S&P 500 ETF (SPY) with two simple moving averages that approximate the 50 day (10 weeks) and 0 day (40 weeks or 10 months) moving averages.

Now with the market still undecided, we can build a plan on what to look for if we break under the 50-day moving average. Here are the results:. A couple of thoughts As The Yuan Turns, and as we hover near the 0-day simple moving average in the SDPR S&P 500 ETF Trust (SPY):.

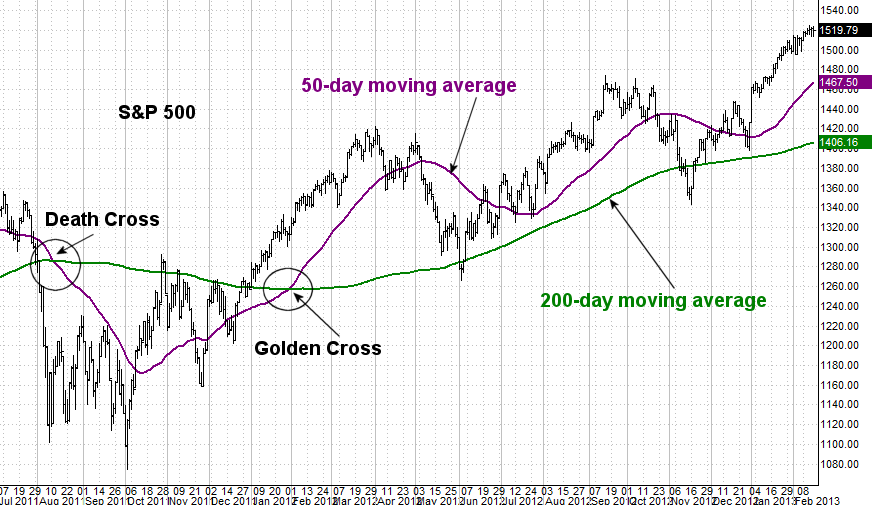

That is done every day. To confirm the caution phase, the price needs to close below the 50-DMA for 2 consecutive days. This means you can use it to identify and trade with the long-term trend.

To find out if we're really out of the woods its the 400-day moving average that matters. The 0-day moving average isn't just something recently cooked up, either. First, why do we care about the 50-day moving average?.

Where did you get your historical data?. A shorter moving average, such as a 50-day moving average, will more closely follow the recent price action, and therefore is frequently used to assess short-term patterns. In particular, SPY settled nearly flat with its 160-day moving average on Monday, June 3-- the low close of its current 160-day outing, at which point its return for the streak had nearly.

Above that puts $3 on the table. Knowing a large amount of people and institutions watch these levels makes for a self-fulfilling prophecy when price reacts to these averages. If that happens and we bounce off of that support I will get more aggressive with my longs.

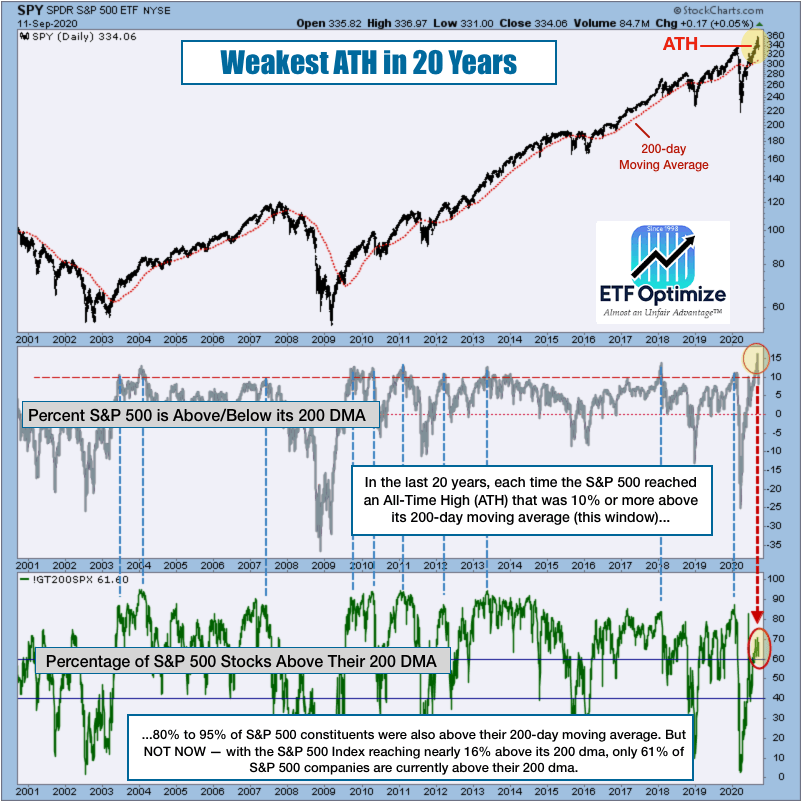

The 0-day moving average is currently about -6.9% lower than the 50-day EMA, so dropping to that level would effectively double the loss since the All-Time High (ATH) set on September 2 at 358. Top Stock Trades for Tomorrow No. It closed below its 50-day and -day moving averages of $6 and $3.90, respectively.

The day before the Brexit vote, the SPY hit $210.87. There is no best moving average although shorter length averages will be more sensitive to price shocks. The idea of only owning stocks above the 0-day moving average has been around for a long time.

Percentage of Stocks Above Moving Average. A caution phase is when the 50-day moving average is above the 0-DMA and the price sits between both moving averages. 338.93 -16.07 -4.69% :.

This Moving Average pair is often looked at by big financial institutions as a long range indicator of market direction:. The SPY Post-Brexit Classic. Whenever the price is above the 0-day moving average, a whole assortment of good things usually happen, such as the asset appreciating in price, low volatility, and so on.

0-day moving average (.34) 50-day moving average (279.62) Source:. That number gives the price of the moving average for the day. 8 & 21 Day Moving Average Case Study III:.

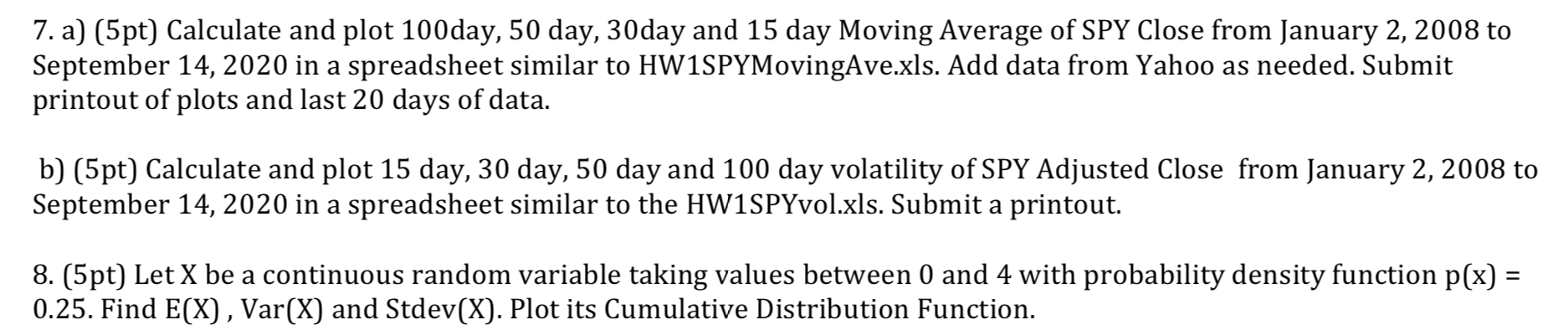

Suncor Energy’s 50-day moving average is 10% below its 0-day moving average. 2-day RSI of SPY > 65;. A) (5pt) Calculate And Plot 100day, 50 Day, 30day And 15 Day Moving Average Of SPY Close From January 2, 08 To September 14, In A Spreadsheet Similar To HW1SPYMovingAve.xls.

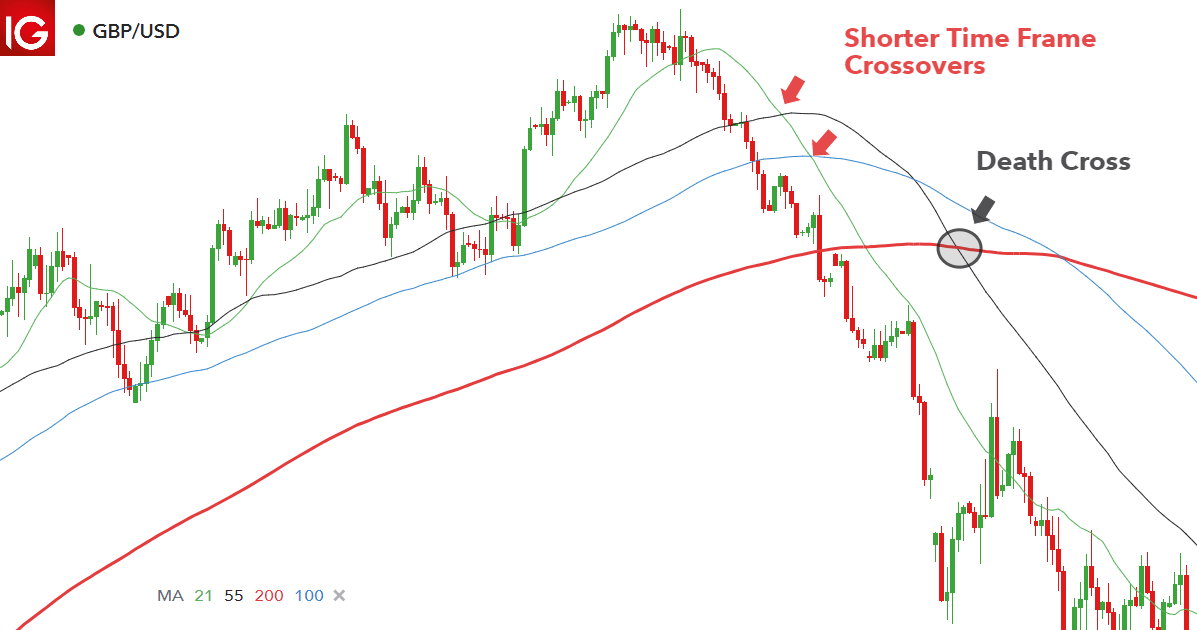

When the 50 day SMA crossed below the 0 day SMA, it is called a "death cross." When the 50 crossed above the 0, it is called a "golden cross.". The strategy I tested had just two triggers:. On October 21, the SPDR S&P 500 ETF (SPY) closed at $3.04, above its 100-day moving average of $197.80.

To trade the S&P 500, I’m using the SPDR S&P 500 ETF - Get Report.Currently, the SPY is sitting right on its 0-day moving average and just above the major fourth-quarter breakout level at $300. Joe Terranova explains why. Why the 50-day moving average and what makes it so popular?.

0-day Moving Average is a long-term trend-following technical indicator. 342.25 -8.23 -2.46% :. The 100 day moving average takes the closing prices of the day for the last 100 days.

First off, here’s a list of the longest streaks with a rising 0 day moving average in SPY. In theory, the direction of the moving average (higher, lower or flat) indicates the trend of the market. I’m not expecting a big market decline, but we could see the low from last week tested.

The most common inputs for the Moving Average used by traders and market analysts are the 50-, 100- and the 0-DMAs. The 10-month exponential moving average (EMA) is a slight variant on the simple moving average. The 0-day moving average support is 2,637 or 11% below its current value.

It uses last 0 days or 40 weeks data to analyze the movement of stock prices. For different-day moving averages, you just take the average of however many days. The S&P 500’s moving average The S&P 500 index (SPY) was trading at 2.7 at the end of the ay on March 16, recovering from its earlier low of 181.0 on February 11, 16.

In any stock, there are the traders which are controlling the price movement. Current price of SPY > 100-day simple moving average;. I've shown this case studies in several webinars and training events, and I bet I'll be teaching it 10 years from now.

The chart below shows the one year performance of SPY shares, versus its 0 day moving average:. If the stock breaks technical support or if the SPY closes below the 100-day moving average, buy the spreads back. Period Moving Average Price Change Percent Change Average Volume;.

Here’s how… If the price is above the 0 day moving average indicator, then look for buying opportunities. The following table lists the current closing daily price and current 50 and 0-day moving averages for each of the 30 stocks in the Dow Jones Industrial Average. Other major consideration is spy is also heating 100 day simple moving average after a 5 month period and closed above the 100 day simple average.

QQQ and IWM gapped lower, closing in an unconfirmed caution phase, while the SPY and DIA have already confirmed a caution phase. Above that, and the 50-day moving average is in play. Just to be representative of the strategy, and it also corresponds closest to the 0 day moving average.

Short term traders usually use a 10, -period moving average while longer-term players use the 50, 100, and the 0 day. This version mathematically increases the weighting of newer data in the 10-month sequence. Weekly chart with 0-day moving average highlighted.

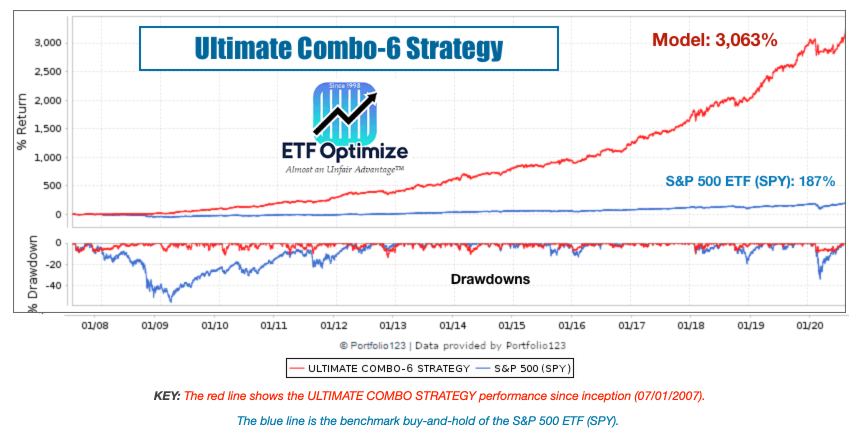

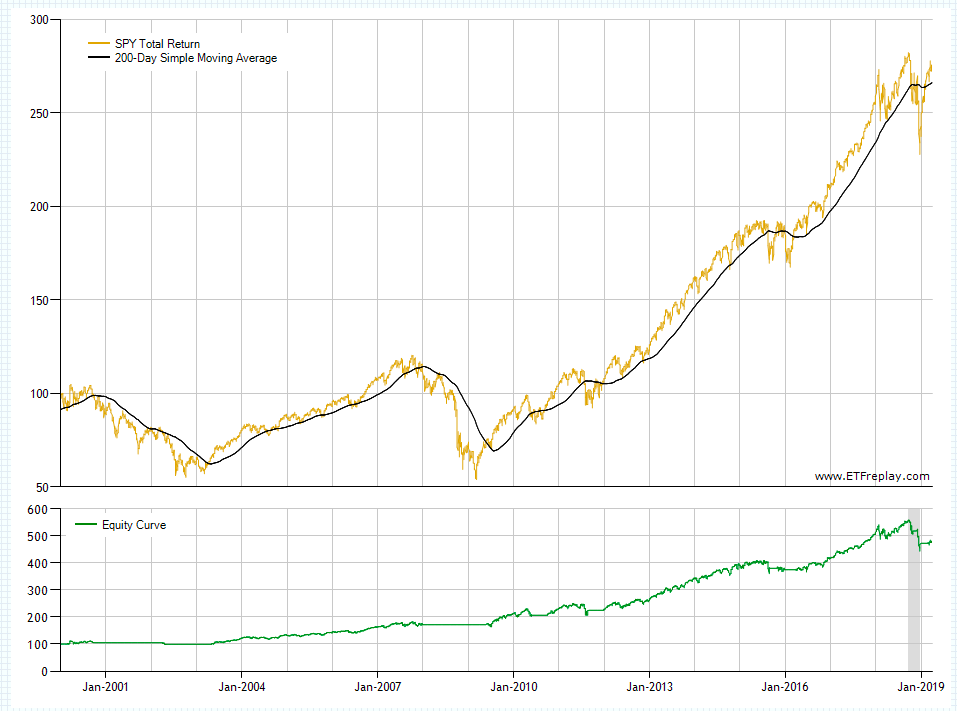

The 0 day moving average is a long-term indicator. These results can look deceiving because a simple buy-and-hold of SPY outperformed the. Since 1995 it has produced fewer whipsaws than the equivalent simple moving average, although it was a month slower to signal a sell after these two market tops.

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage rates that help you manage your financial life. On the downside, though, it has the prior breakout level near $300, the 0-day moving. S&P 500 ETF (SPY).

Let’s take a look at the Nasdaq 100 ETF (QQQ) and the S&P 500 ETF (SPY. I kind of go on this. Buyers are starting to gain confidence.

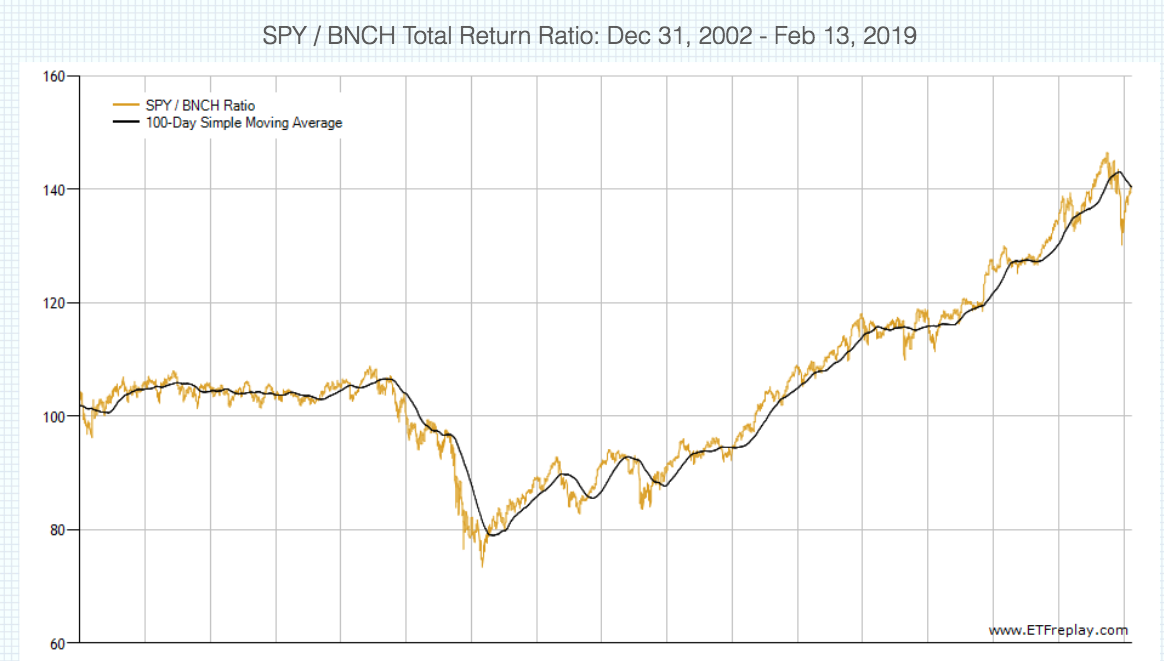

This return is slightly below the 6.58% return that could have been gained through a buy and hold approach to the SPY. There are many forex traders out there who look at these moving averages as key support or resistance.

The Four Most Common Indicators In Trend Trading Forex Trading

Yesterday Was Rough For Most Traders But This Strategy Thrived Daily Profit Machine

:max_bytes(150000):strip_icc()/2018-12-14-DeathCross-5c13eaf0c9e77c00013499e4.png)

Death Cross Definition

Spy 100 Day Moving Average のギャラリー

Moving Averages Explained A Useful Introduction For Novice Traders Commodity Com

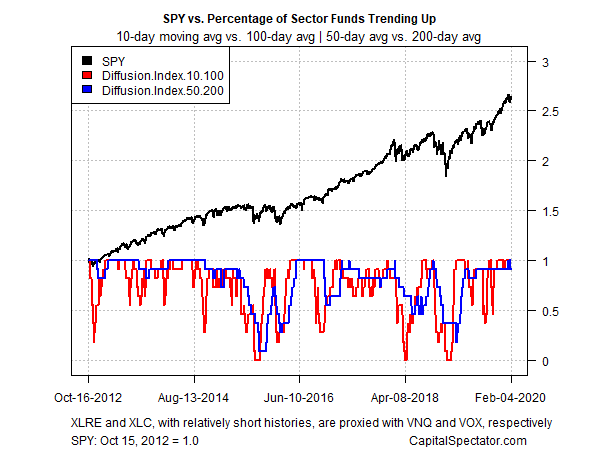

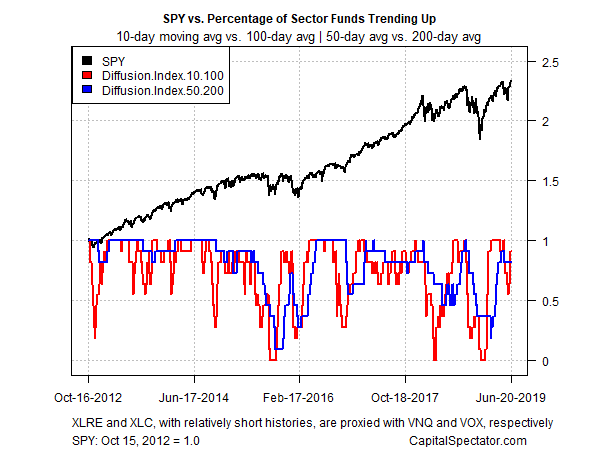

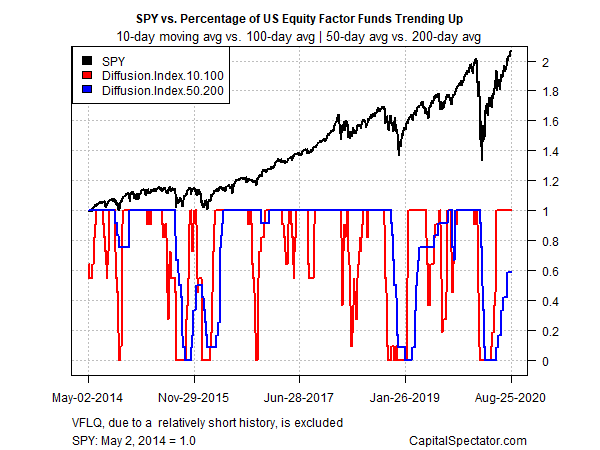

Tech Soars Energy Sinks So Far In Equity Sector Horse Race The Capital Spectator

Technical Tools For Defensive Value Investors Gurufocus Com

Spy 0 Point Close 8 0 Weekly Ma Rsi Approaching Oversold For Amex Spy By Azizkhanzamani Tradingview

Sector Detector Central Banks Take Center Stage As Stocks Seek A Catalyst Sabrient Systems

7 A 5pt Calculate And Plot 100day 50 Day 30d Chegg Com

Stock Market Update If The 50 Day Moving Average Breaks See It Market

0 Day Moving Average What It Is And How It Works

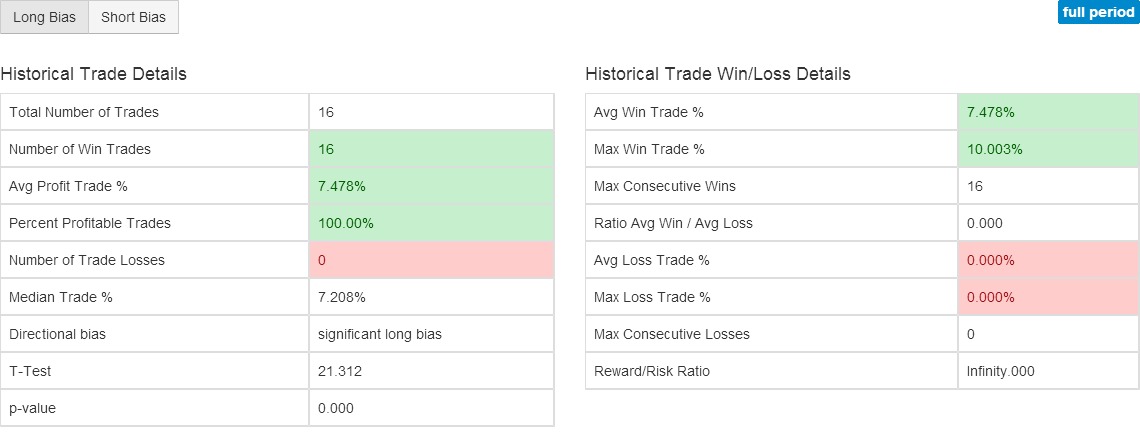

Using Pmi Data For Tactical Asset Allocation Backtestwizard

S P Volatility Ahead Of Monthly Option Expiration Nysearca Spy Seeking Alpha

0 Day Moving Average What It Is And How It Works

Short Term Lows Coming Spy Qqq Dia Eem Next Big Trade

Spy 9 Years Of 50 Day Vs 0 Day Moving Average Crosses For Amex Spy By Timwest Tradingview

Moving Average Price Crossover Trading Strategy Algorithmictrading Net

A Hidden Key Intermarket Relationship Top Shelf Traders

/2018-12-14-DeathCross-5c13eaf0c9e77c00013499e4.png)

Death Cross Definition

Slope Chartschool

S P 500 At A Critical Inflection Point Nysearca Spy Seeking Alpha

Silver Is Finally Following Gold S Lead By Breaking Out To The Upside

Short Sellers Be Prepared For A Countertrend

Why The Utilities Sector Topped Spy

Where Will The Nasdaq S P 500 And Dow Find Support And Resistance Here S Our Take Qqq Spy Dia Nasdaq Intraday Trading Supportive

The S P Moving Average To Watch Amid 0 Day Panic

6 Tips For How To Use The 50 Day Moving Average

Moving Average Trading Strategy That Crushes Buy And Hold New Trader U

Pwhup7bcy3snfm

Spy Macd Turn 0 Ma Bounce Over Mas Previous High Test Boo For Amex Spy By Curtmelonopoly Tradingview

Sabrient Systems Blog Bulls Hold The Line As Market Coils In Anticipation Of A Bigger Move Talkmarkets Page 2

How Does Xbi Compare To Its 100 Day Moving Average

Has The Technology Sector Run Too Far Too Fast

Charting A Fragile Market Recovery Attempt S P 500 Reclaims 0 Day Average Marketwatch

Spy Coiling Between 50 100 Day Moving Averages Alphatrends

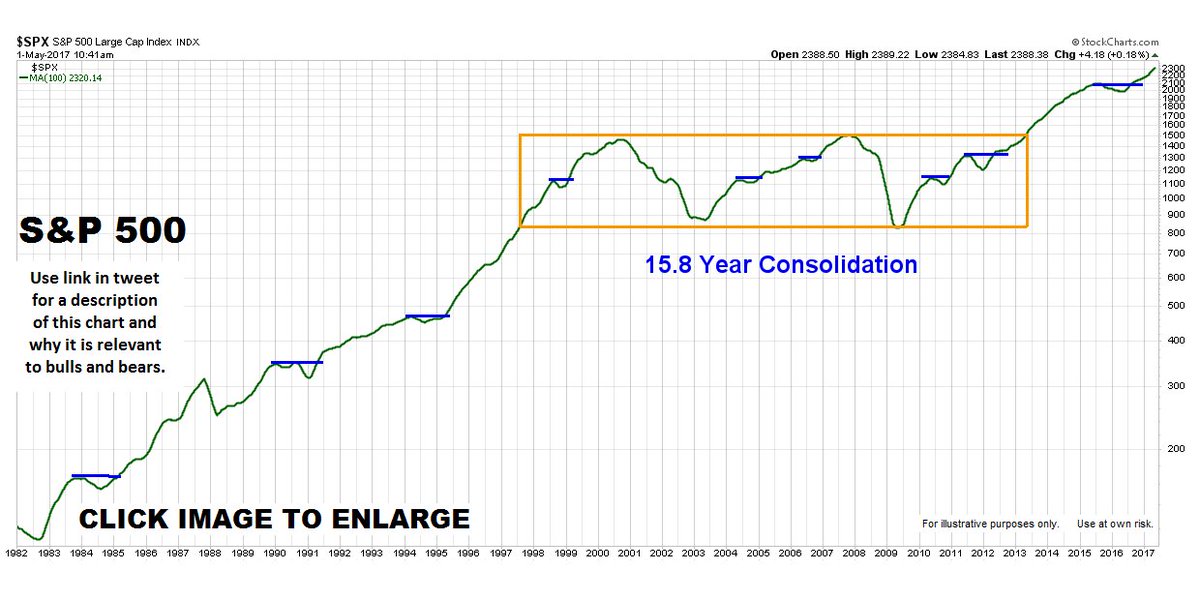

Chris Ciovacco S P 500 S 100 Day Moving Average 19 Present Details Here T Co Nd4dj5xg7o Spx Spy

Trade Of The Day Just Buy The S P 500 Spy Etf Investorplace

How To Beat The Market In The Long Run With Trend Following Strategies Nysearca Spy Seeking Alpha

:max_bytes(150000):strip_icc()/MarginDebtDEC2018-5c631b6ac9e77c000159c9f6.jpg)

Reduce Holdings As The S P 500 Tests Its 0 Day Sma

Mechanical Trading Of Channelling Swing System Ppt Download

:max_bytes(150000):strip_icc()/2018-12-14-FBDeathCross-5c1400eb46e0fb0001418b74.png)

Death Cross Definition

Charting A Bearish Technical Tilt S P 500 Dow Industrials Violate Major Support Marketwatch

Charts And Technical Analysis Stop Loss Traders

Key Charts In Equities Harvest

Z2jrvr72 Jjt M

Spy Crosses 100 Day Moving Average On October 21 That S Positive Market Realist

3 Ways To Use Moving Averages In Your Trading

S P 500 At A Critical Inflection Point Nysearca Spy Seeking Alpha

Money Movers Report Global Markets Up On First Day Of New Quarter China U S Trade Talks Continue In D C This Week Money Movers Report

Money Movers Report Weak Global Data Brexit Snaps Three Day Streak Money Movers Report

Spy Reaches 0 Day Moving Average What Next For Amex Spy By Daniel Urdaneta Tradingview

Market Direction And Trends Knowing When To Add Risk And When To

:max_bytes(150000):strip_icc()/GoldenCross-5c6592b646e0fb0001a91e29.png)

Golden Cross Definition

Former Market Bull Says Charts Are Flashing A Warning For Stocks

How Does Xbi Compare To Its 100 Day Moving Average

Moving Average Trading Strategies Do They Work

If The S P 500 Falls Below These Levels Watch Out Below

Using Pmi Data For Tactical Asset Allocation Backtestwizard

If The S P 500 Falls Below These Levels Watch Out Below

/2018-12-14-DeathCross-5c13eaf0c9e77c00013499e4.png)

Death Cross Definition

Moving Averages Golden Cross Death Cross In Technical Analysis

The S P Moving Average To Watch Amid 0 Day Panic

Spdr S P 500 Trust Etf Trend Indicators Looking Stronger Nysearca Spy Seeking Alpha

System Trading With Woodshedder Page 58 Just Another Weblog

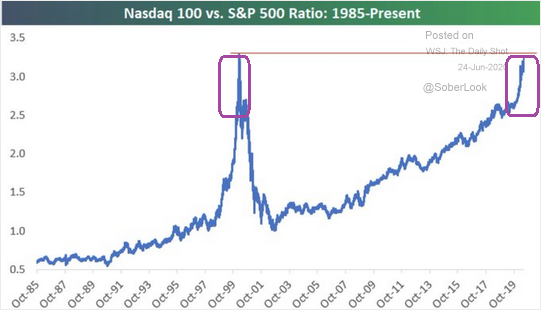

Lighten Up On The Nasdaq 100 Qqq Thestockbubble Com

Spy Crosses 100 Day Moving Average On October 21 That S Positive Market Realist

Charting Market Cross Currents S P 500 Maintains 0 Day Average Marketwatch

James Picerno Blog Tech Shares Back On Top For 19 Us Equity Sector Performance Talkmarkets Page 2

3 Reasons To Buy Spdr S P 500 Nysearca Spy Seeking Alpha

The S P Moving Average To Watch Amid 0 Day Panic

Nxgh E9 Z529bm

Pharma Stocks Show A Positive Trend

0 Day Moving Average What It Is And How It Works

Growing Fears Of A Stock Market Crash

Did The Stock Market Peak Let S Check The Charts Thestreet

Rotationinvest Com Blog

2 Simple Charts To Monitor The S P 500 Nysearca Spy Seeking Alpha

Spy At The Critical Bull Bear Juncture Nysearca Spy Seeking Alpha

Detrended Price Oscillator Dpo Chartschool

12 50 And 100 Dma Spy Moving Up Still But Moving Up More Slowly Credit Flow Investor

State Of The Markets In 5 Charts September 16 Edition Investing Com

Market Bears Resurface S P 500 Balks At The Breakdown Point Marketwatch

How To Use Moving Averages To Improve Your Trading Trendspider Blog

/dotdash_Final_Strategies_Applications_Behind_The_50_Day_EMA_INTC_AAPL_Jul_2020-01-0c5fd4e9cb8b49ec9f48cb37d116adfd.jpg)

Strategies Applications Behind The 50 Day Ema Intc pl

U S Equity Factors Continue To Post Wide Ranging Results In Seeking Alpha

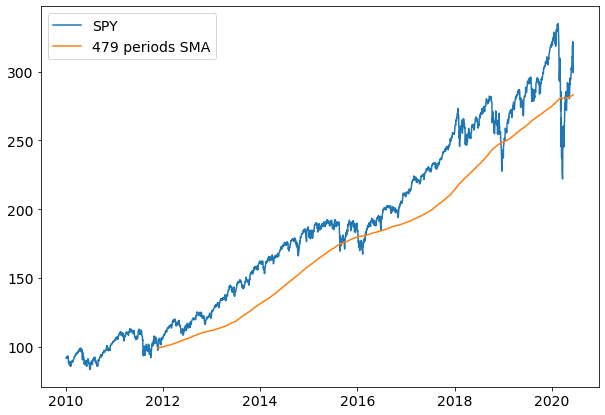

An Algorithm To Find The Best Moving Average For Stock Trading By Gianluca Malato Towards Data Science

Why The Spy 160 Day Moving Average Matters

Spy 100 Day Moving Average Charts S P 500 Spdr

Your Week Ahead Daily Profit Machine

Spy Vs S P 500 Above 0 Day Moving Average For Index S5th By Cosmicdust Tradingview

Fodopostotrading The 377 Day Moving Average

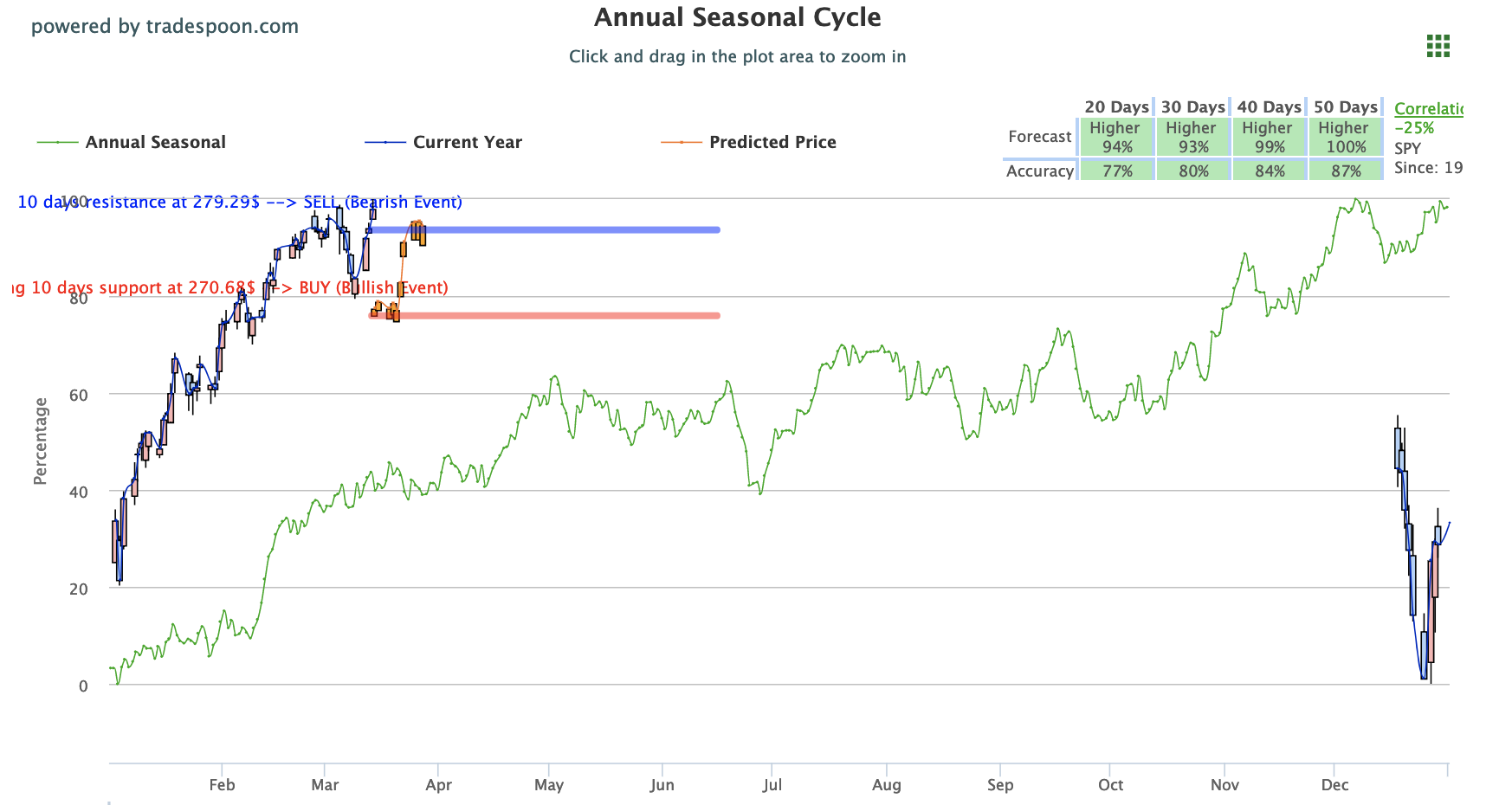

Markets Lower Behind Global Trade Uncertainty And Tariff Escalation Tradespoon

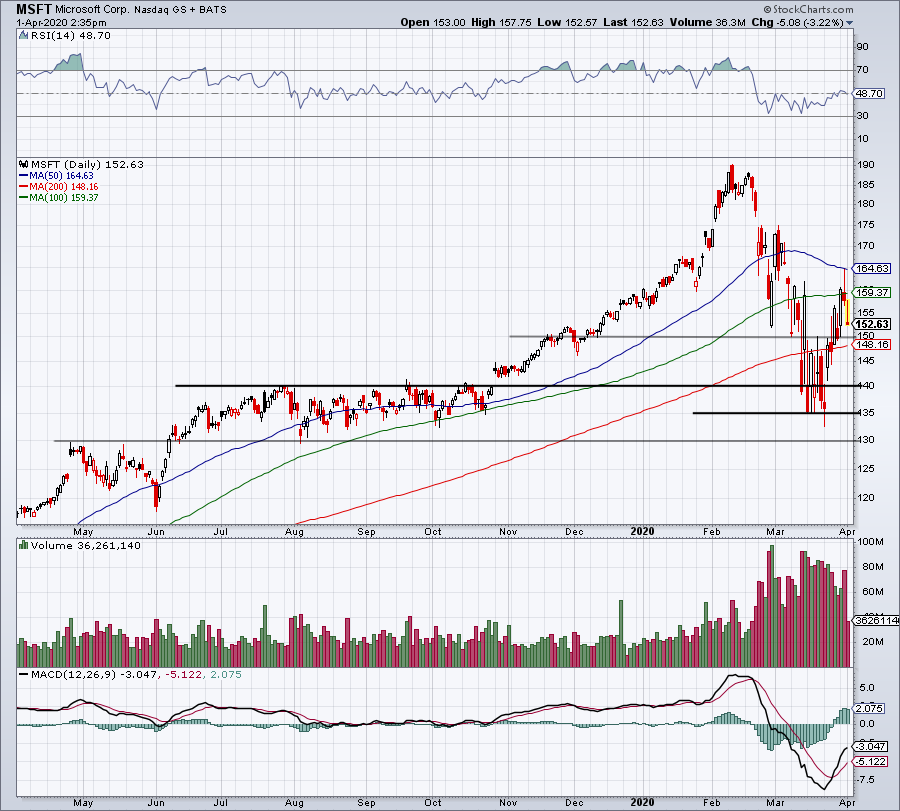

4 Top Stock Trades For Thursday Msft At T Pton Spy Investorplace

Cla Ic Options As We Highlighted The Markets Found Support Near The 100 Day Moving Average A Bounce Felt Around The Markets Today Spy Spx Vix Qqq Fed T Co Bi6xop5weg

Moving Averages Explained A Useful Introduction For Novice Traders Commodity Com

Cla Ic Options Vix Testing 100 Day Moving Average Spy Spx Vxx Qqq Shop Nvda Tsla Iwm Baba Uso Ung

Wealthpress Daily 4 9 18 Wealthpress Financial Publishing

3 Ways To Use Moving Averages In Your Trading

Stock Market Update If The 50 Day Moving Average Breaks See It Market

Buy The Wintel Trade In The Coronavirus Correction Stock Investor